Геополитические потрясения и новая карта мировой торговли: как конфликты меняют глобальные торговые потоки (на примере кризиса в Красном море)

Геополитические потрясения и новая карта мировой торговли: как конфликты меняют глобальные торговые потоки (на примере кризиса в Красном море)

Аннотация

В статье дается всесторонний анализ значительных преобразований в мировой экономике, особенно в области международной торговли, которые были вызваны технологическим прогрессом, сменой политических идеологий и различными геополитическими потрясениями. Эти потрясения часто становятся поворотными моментами, которые требуют пересмотра и реорганизации существующих торговых отношений, оказывая тем самым глубокое влияние на ситуацию на международном рынке. По мере роста геополитической напряженности традиционные экономические связи все больше разрушаются, что приводит к появлению новых и зачастую неожиданных альянсов. В исследовании подчеркивается многополярный характер современной геополитики, которая влияет не только на отдельные страны, но и на целые регионы, усложняя условия мировой торговли.

Особо следует отметить геополитическую напряженность вокруг Красного моря, жизненно важного транспортного коридора, который включает в себя Суэцкий канал, на долю которого приходится примерно 12% мировой торговли. Подчеркивается стратегическое значение этого региона для крупных экономик, таких как Китай, Индия, государства — члены ЕС и Соединенные Штаты, особенно в свете недавних конфликтов, угрожающих безопасности на море. Военные столкновения между Израилем и ХАМАСОМ в 2023–2024 годах являются примером того, как подобные конфликты могут нарушить судоходные маршруты, вынудив значительную часть судов изменить маршрут вокруг мыса Доброй Надежды. Это изменение маршрута привело к увеличению сроков доставки и беспрецедентным затратам на доставку, которые выросли на 243%, наряду со значительным ростом расходов на топливо и страховых взносов.

Статья количественно иллюстрирует эти экономические последствия, включая резкое увеличение стоимости доставки с 2000-3000 долларов до 5000-6000 долларов за контейнер. Такие изменения привели к сокращению перевозок через Суэцкий канал на 30% и создали серьезные проблемы для стран, зависящих от этого важнейшего торгового маршрута. В целом, это исследование подчеркивает сложную взаимосвязь между геополитикой и экономикой, показывая, как современные конфликты меняют глобальные цепочки поставок и динамику торговли.

Геополитическая нестабильность на Ближнем Востоке создает для российского бизнеса тактические преимущества в энергетике, сельском хозяйстве, экспорте вооружений и логистике на новой карте мировой торговли. Хотя это краткосрочные выгоды от глобальной нестабильности, Россия использует их для достижения стратегических целей: диверсификации торговых путей, укрепления связей с незападными странами и обеспечения более влиятельного положения в меняющемся многополярном мировом порядке.

1. Introduction

The global economy, particularly international trade, has undergone significant changes over the past decades. These changes are driven by technological innovations, shifts in political ideologies, and numerous geopolitical shocks. These shocks often act as the main catalyst for revising and reorganizing existing trade relations, which directly impacts the entire international market. In times of growing instability caused by conflicts, the world is witnessing the breakdown of traditional economic ties and the emergence of new, often unexpected alliances. Modern geopolitics is characterized by its multipolar nature, affecting not only individual countries but entire regions.

This study aims to provide a comprehensive analysis of geopolitical shocks and their impact on world trade, as well as to identify new trends and prospects in the changing global landscape. The results of this analysis will help to better understand the complex relationships between geopolitics and economics.

The relevance of this research is driven by rapid changes in international politics and economics, which significantly influence global trade relations. These changes are best examined through specific examples.

2. Main results

Modern conflicts — ranging from military clashes to trade wars – have become key drivers of the disintegration of global supply chains. Their consequences extend far beyond local crises. For instance, the Red Sea is one of the most important transport corridors connecting Europe, Asia, and Africa. It is home to the Suez Canal, a vital artery through which about 12% of global trade passes daily, including oil, gas, containers with goods, and other critical cargo. This region is of strategic importance for countries like China, India, EU member states, and the United States, which rely on uninterrupted supplies of energy and goods , .

However, in recent years, the Red Sea has become a hotspot of geopolitical tension. Conflicts in Yemen, piracy, and the involvement of external powers (such as Iran and Saudi Arabia) have created threats to maritime security. As a result of the crisis in the region, attacks on commercial ships have increased, forcing many companies to seek alternative routes , .

Following the military clashes between Israel and Hamas (2023-2024), 70–80% of ships were forced to reroute around the Cape of Good Hope instead of using the Suez Canal. This not only increased delivery times by 10–14 days but also raised shipping costs by a record 243%, with fuel expenses growing by 40% , .

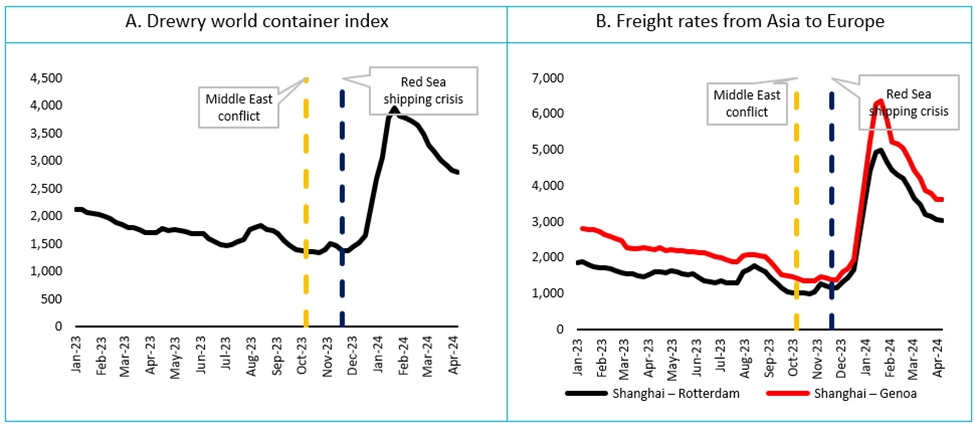

From an economic perspective, it is important to note the sharp rise in shipping costs and insurance premiums, which significantly contributed to global inflation and negatively impacted the economies of individual countries (Fig. 1) .

Before the Israeli conflict, according to data from January-September 2023, the average cost of shipping a 40-foot container from China to Europe ranged from 2,000 to 3,000 USD. However, after the conflict began, prices soared to a record 5,000−6,000 USD. This increase forced many companies to reconsider their logistics routes, despite already incurring multimillion-dollar losses. Insurance premiums also rose significantly during the crisis. Previously, insurance premiums were around 0.1% of the total cargo value, but after the conflict, due to active military actions and increased risks, premiums rose to 1% .

Figure 1 - Cost of shipping 40-foot containers on two major routes: Shanghai-Rotterdam and Shanghai-Genoa via the Suez Canal during the Red Sea crisis

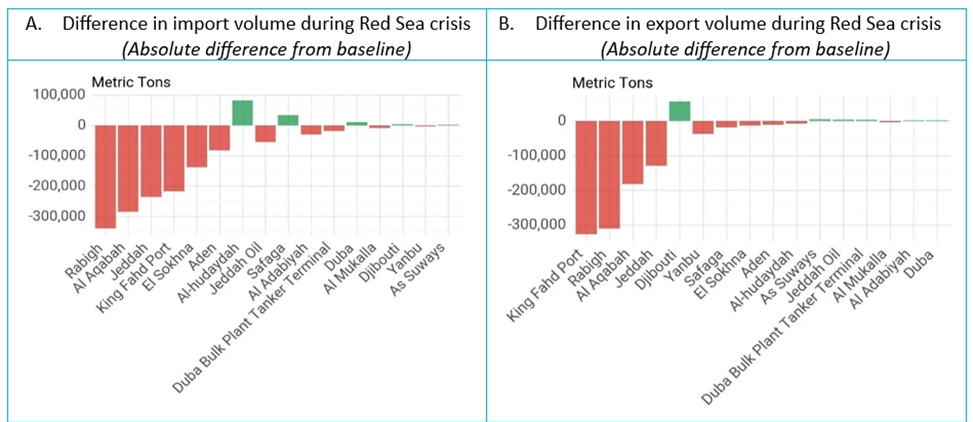

Figure 2 - Difference in import/export volumes during the Red Sea crisis compared to baseline levels

In response to the Red Sea crisis, companies and countries began actively using alternative routes for transporting goods. The most significant alternatives include:

· The Arctic route, which could reduce shipping distances between Asia and Europe by 40%.

· The "New Silk Road" from China to Europe, passing through mainland territories.

· Trans-Pacific routes, which could increase trade volumes between Asia and North America, reducing dependence on European markets.

The shift in shipping routes has prompted a reevaluation of global trade strategies, with businesses increasingly prioritizing resilience over cost-efficiency. As companies adapt to the volatile geopolitical landscape, they are investing in diversified supply chains that can mitigate risks associated with reliance on any single route or region. This trend is evident in the growing interest in nearshoring and friend-shoring practices, where businesses relocate production closer to their end markets or to politically stable countries. For instance, manufacturers are exploring opportunities in Southeast Asia, Eastern Europe, and Latin America as alternatives to traditional hubs in China and other regions affected by geopolitical tensions.

Furthermore, the adoption of advanced technologies, such as blockchain for supply chain transparency and artificial intelligence for predictive logistics, is becoming crucial in navigating the complexities of modern trade. These innovations not only enhance operational efficiency but also provide businesses with the agility needed to respond swiftly to disruptions. As a result, the landscape of global trade is evolving, with an emphasis on adaptability and strategic foresight becoming essential for maintaining competitiveness in an increasingly uncertain world.

How Russian Business Profits from Middle Eastern Turbulence

Geopolitical shocks in the Middle East, traditionally perceived as a factor of global risk, are creating unexpected opportunities for Russian economic entities on the new map of world trade. After the fundamental restructuring of logistics and economic ties that began in 2022, Russia has learned to adapt quickly and find advantages in conditions of instability . The Middle Eastern crises are becoming another catalyst for these processes.

Energy industry is seeing redistribution of flows and increased margins. The key beneficiary of the ongoing instability in the region is the Russian fuel and energy sector. The Middle East is a major player in the oil market. The escalation of conflicts and threats to shipping in the Red Sea (Houthi attacks) lead to an increase in global prices for oil and gas due to risk premiums and more expensive logistics.

For Russia, this translates into:

– Increased export revenues: Even with enforced price caps and sanctions, rising overall prices allow for increased budget revenues.

– Strategic importance of the Northern Sea Route (NSR): Against the threat to traditional routes via the Suez Canal, the Northern Sea Route is being actively positioned by Russia as a safe and predictable alternative. This stimulates investment in Arctic port infrastructure and attracts the attention of Asian partners.

– Negotiations with OPEC+: The tension gives Moscow additional leverage in negotiations with the cartel, allowing it to argue for the need for a more flexible or favorable quota policy.

In terms of agriculture and food security, Russia, as one of the world's largest exporters of grain and other food commodities, gains such long-term advantages as reduced competition (conflicts and logistics crises paralyze agriculture and export capabilities of the countries in the region themselves and increase transport costs for competitors from Europe and America, making Russian products more price-competitive) and new logistics corridors (alternative supply routes are actively developing, in particular through Iran and the Persian Gulf countries, which diversifies export routes and reduces dependence on traditional directions) .

One more realm that benefits from the current geopolitical status quo is military-technical cooperation (MTC). The Middle East region has historically been one of the main consumers of Russian weapons. The escalation of conflicts directly leads to increased demand for air defense and strike systems. Countries in the region, concerned for their security, are actively increasing defense orders. Russian systems, such as the Pantsir-S1 air defense or Orion strike drones, are in demand as proven and relatively affordable solutions.

Logistics and consumer goods market are also going through significant changes. European and American companies, faced with rising costs and risks when delivering goods via the Suez Canal, are looking for alternatives. Russian logistics operators are offering solutions through Russian territory, developing multimodal transport (rail, NSR). This stimulates the development of domestic transport infrastructure and generates transit income.

Furthermore, domestic producers of consumer goods, who have already replaced departed brands on the domestic market, get a chance to boost their exports to countries in the region, where Western goods may also become less accessible.

3. Conclusion

In conclusion, the ongoing geopolitical tensions, particularly in the Red Sea region, have highlighted the fragility of global supply chains and the profound impact that modern conflicts can have on international trade. The significant rise in shipping costs, extended delivery times, and increased insurance premiums following the military clashes between Israel and Hamas serve as a stark reminder of how quickly economic stability can be disrupted by geopolitical events. The Suez Canal, a critical conduit for global commerce, has experienced a dramatic decline in traffic, resulting in substantial financial losses for countries like Egypt that rely on its revenue.

As businesses and nations adapt to these challenges, the exploration of alternative trade routes, such as the Arctic route and the "New Silk Road", underscores a pivotal shift in global logistics strategies. This evolution not only reflects the immediate need to mitigate risks associated with current conflicts but also signals a broader reconfiguration of international trade dynamics. Moving forward, it is essential for policymakers and industry leaders to recognize the interconnectedness of geopolitics and economics, fostering resilience within supply chains to better withstand future disruptions. The lessons learned from this crisis will undoubtedly shape the future of global trade, compelling stakeholders to prioritize security and adaptability in an increasingly volatile world.

It is important to understand that global instability is always a risk for all participants. However, the current environment allows Russian businesses and the state to solve strategic problems: diversify logistics, strengthen relations with countries of the "Global South", increase export revenues, and promote national infrastructure projects.

The Middle Eastern shocks are accelerating the process of forming a new, multipolar architecture of world trade, and Russia, by seizing current opportunities, is striving to secure a stronger and more independent position within it.